Security & Privacy

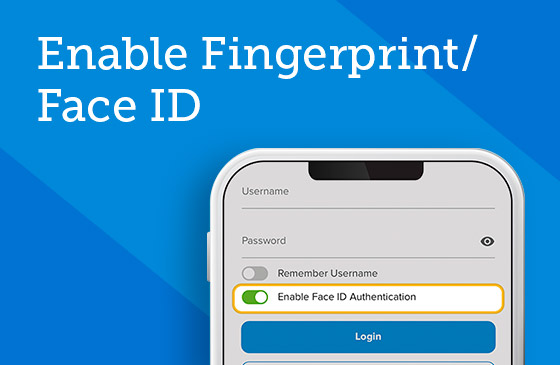

Enable Fingerprint/Face ID

Log in to digital banking without having to use your credentials.

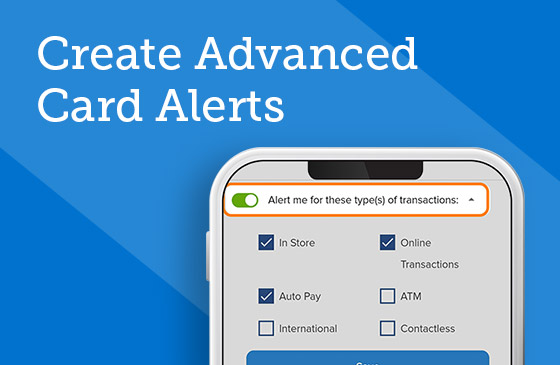

Create Advanced Card Alerts

Receive notifications when certain transactions are made and your card is declined.

Add Login Security Validation

Enable additional security validation for your account for an extra layer of security.

Change Username & Password

Check out these simple steps for changing your username and password.

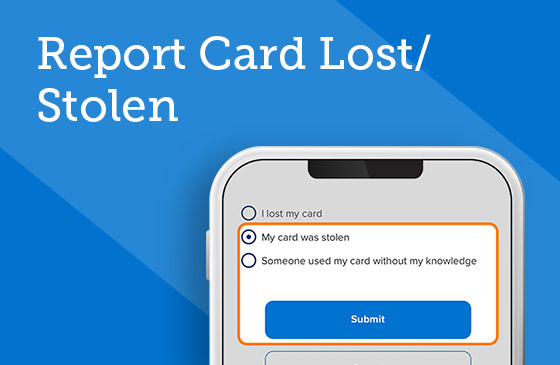

Report Card Lost/Stolen

Cancel your misplaced or stolen card and order a replacement within seconds.

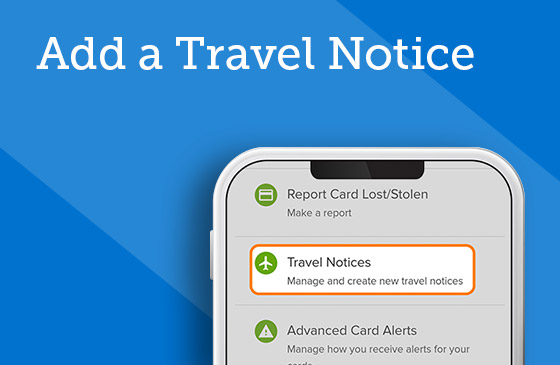

Add A Travel Notice

Enter trip details, like where you’re going and how long you’ll be gone, to prevent declines.

Set Subscription Alerts

Receive alerts when balances are low, checks clear, loans are coming due, and more.

Set Security Alerts

Receive an email, text, or push notification when suspicious activity occurs on your account.