Banking digitally is like having a secure and convenient virtual bank in the palm of your hand.

Starting with the introduction of smartphones and mobile apps, there has been a paradigm shift in the way consumers go about their everyday banking. By combining mobile and online banking services, digital banking has become the preferred way to bank. According to a WalletHub study, 77% of consumers today choose digital banking over traditional banking methods. And the shift has been swift—in a span of just eight years (2014-2022), the number of Americans using a mobile banking app rose from 38% to 64%.

Starting with the introduction of smartphones and mobile apps, there has been a paradigm shift in the way consumers go about their everyday banking. By combining mobile and online banking services, digital banking has become the preferred way to bank. According to a WalletHub study, 77% of consumers today choose digital banking over traditional banking methods. And the shift has been swift—in a span of just eight years (2014-2022), the number of Americans using a mobile banking app rose from 38% to 64%.

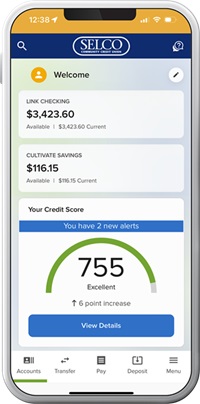

SELCO’s digital banking has followed that trend—84% of logins are via our mobile app. Here’s a snapshot of how banking digitally with SELCO can become a creature comfort while giving you peace of mind knowing your information is safe.

Convenience

SELCO’s digital banking gives our members a 360-degree view of all their accounts (even those at other institutions) and loans from a single login via a phone, tablet, or desktop screen. The following just scratches the surface of the variety of free services we provide:

SELCO’s digital banking gives our members a 360-degree view of all their accounts (even those at other institutions) and loans from a single login via a phone, tablet, or desktop screen. The following just scratches the surface of the variety of free services we provide:

- Card management and alerts. Manage SELCO debit and credit cards by setting travel notices, reporting them lost or stolen, having a replacement digital card issued, and more.

- Mobile deposit. The free SELCO app and your phone’s camera are all you need to deposit checks. And in most cases, the funds are available immediately.

- Same-day external transfers and payments. Not only can money be seamlessly moved between SELCO accounts, transfers to external institutions can be scheduled to arrive on the same business day.

- Person-to-person payments. Look for Zelle® in the SELCO app to send money quickly and easily to friends and family.*

- Face/fingerprint ID. Place an extra layer of security on SELCO accounts by enabling one of these biometric authentication methods.

- Live and virtual chats. Chat with a live representative—or with our virtual agent after hours—for answers to burning questions.

- Credit score tracking. Check your credit score in real time, any time—as often as you’d like.

You can access these features—and many more—with a few taps, swipes, or clicks.

Peace of mind

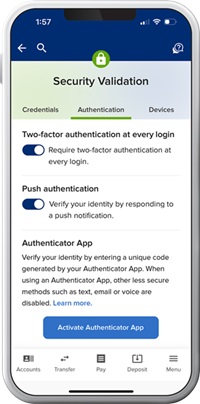

From the moment you register for digital banking, a wall is constructed behind your login to protect all of your sensitive information. Here are a few ways your accounts are protected in digital banking:

From the moment you register for digital banking, a wall is constructed behind your login to protect all of your sensitive information. Here are a few ways your accounts are protected in digital banking:

- End-to-end security. We protect your hard-earned money with multiple layers of modern authentication and security at every login—and throughout the digital banking experience. Boost your protection further by opting for enhanced features such as push authentication, authenticator apps, fingerprint or face ID, and optional account and card alerts on top of our standard default security alerts.

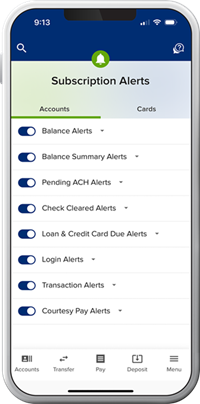

- Speaking of alerts … With an a la carte approach to setting alerts, you can keep track of your accounts the way you want. You can select every type of alert we offer or just the ones necessary for your needs.

- Security alerts. Get notified of suspicious digital banking activity by enabling push or text notifications.

- Subscription alerts. Monitor your account and card activity with a number of alerts. Examples of actions you can set to trigger an alert include:

- Account-based. When your balances, deposits, or withdrawals reach a certain amount; pending ACH transfers; and login attempts.

- Card-based. Transaction and merchant types, when cards are declined, and when you exceed spending limits.

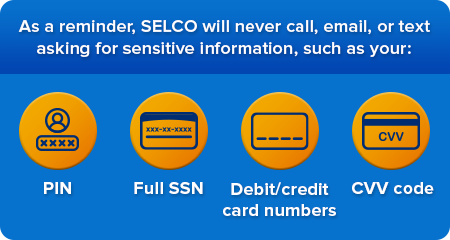

To help our members stay a step ahead of scams and fraud, such as phishing attempts, we also offer resources like our Security Center. If you suspect that you’re a victim of fraud, contact SELCO immediately, monitor your credit, and report any internet crimes at ic3.gov. And if you ever receive a mysterious text, email, or phone call claiming to be from SELCO asking for personal information, here’s our promise to you:

SELCO’s digital banking is a safe and convenient way to stay connected to SELCO and your accounts. To help get acclimated to banking digitally, we offer dozens of step-by-step walkthroughs and FAQs at selco.org.

*Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.