Get a great rate on an auto loan

Get a rate as low as 5.24% on a new or used auto loan and make no payments for 90 days.

Certificates

as high as 3.90 %Car Loans

as low as 5.24 % 6.49 %Credit Cards

as low as 10.75 %Whatever a good life means to you, we will help you get there.

Apply for a SELCO Scholarship

Nearly $80,000 in scholarships is available as we again support vocational, continuing, and nontraditional students. The deadline to apply is March 31!

Step up your financial game with Vault

It’s never too early to develop money smarts. Our Vault Youth Savings account features exceptional dividends, financial learning resources, savings incentives, and more.

Still time to contribute to IRA, HSA

If you need to catch up on your IRA or HSA contributions for 2025, you have until April 15 to do so. For 2026, contribution limits for both accounts have increased.

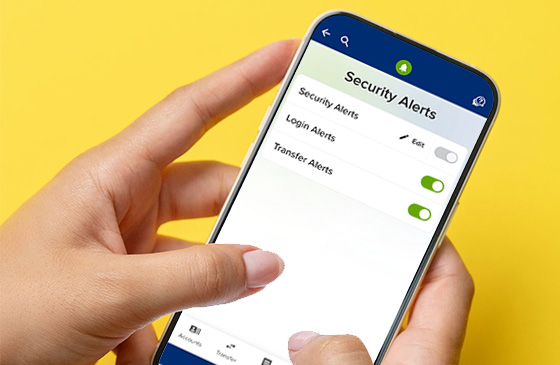

Lock down your SELCO accounts

SELCO has many tools to help keep your accounts safe. Build your personal firewall with push notifications, fingerprint/face ID, card and transaction alerts, and more.

Financial tips and tools

Master Your Financial Journey

Our Education Center is jam-packed with tools to help you reach any of your financial goals, no matter how big or small. Take control of your finances today!

Explore Our Financial Tools

New Credit Score Rules and How They May Affect Borrowers

Credit bureaus are making changes to what goes into a credit score, offering new ways for prospective borrowers to build their credit.