Payments and Transfers

Transfer money seamlessly

Digital banking lets you complete all your regular transactions from anywhere.

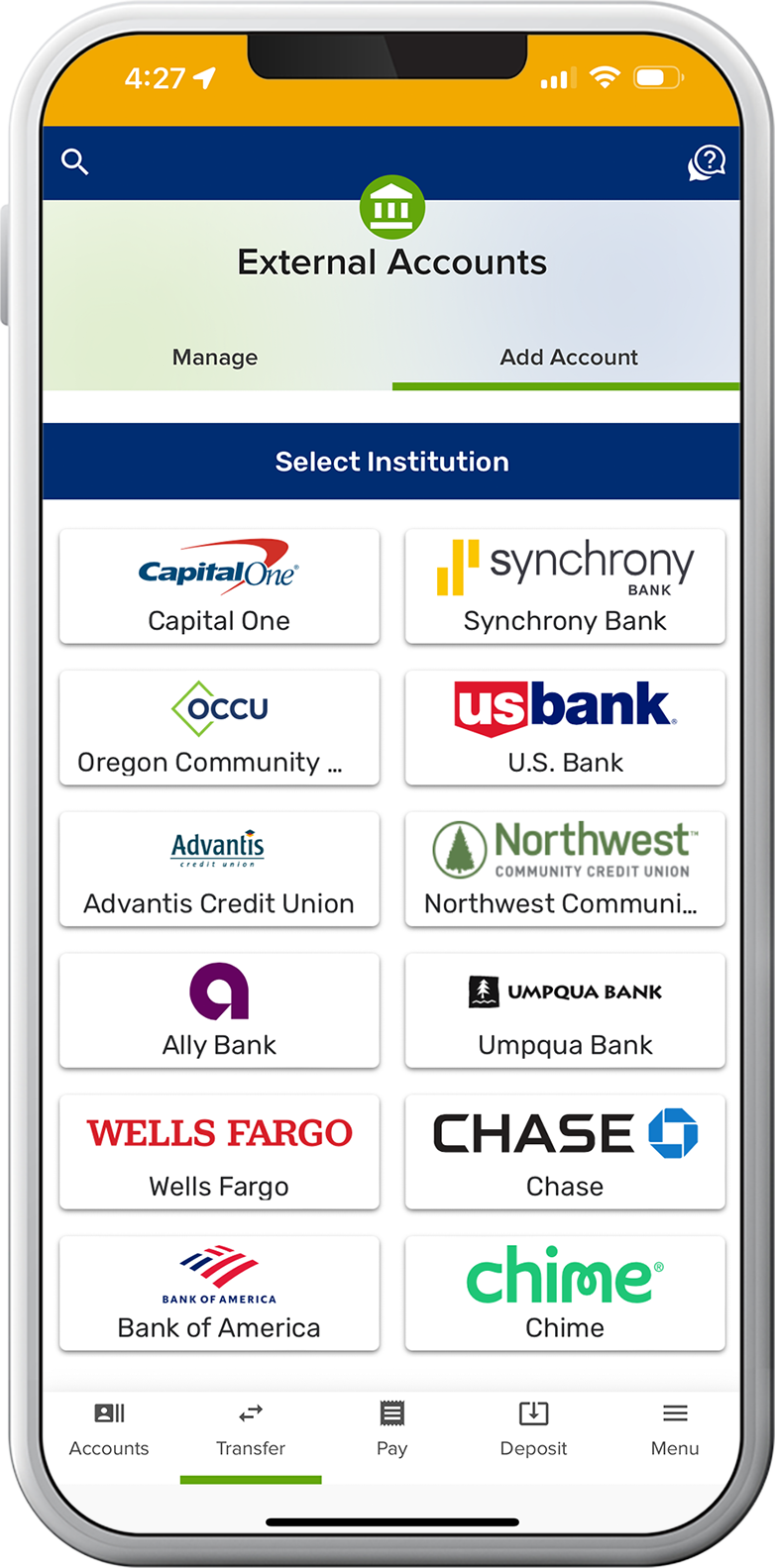

Add external accounts

Connect external accounts to transfer money to your SELCO accounts and loans.

Make loan payments

Set up one-time or recurring payments using internal or external transfers. You can also pay SELCO loans with a non-SELCO debit or credit card.

Pay bills

Manage your bills in one central location by scheduling one-time or recurring payments to companies and individuals.

Automate savings goals

Hit your savings goals (and develop savings habits) with automated, recurring transfers.

Send and receive money fast with Zelle®*

Whether you’re paying rent, gifting money, or splitting the cost of a bill, Zelle® has you covered.

- Zelle® is available in the SELCO app, so there’s no need to download another app.

- There are no fees to use Zelle® in the SELCO app.1

- All you need is an email address or U.S. mobile number. Your account information and activity stay private.

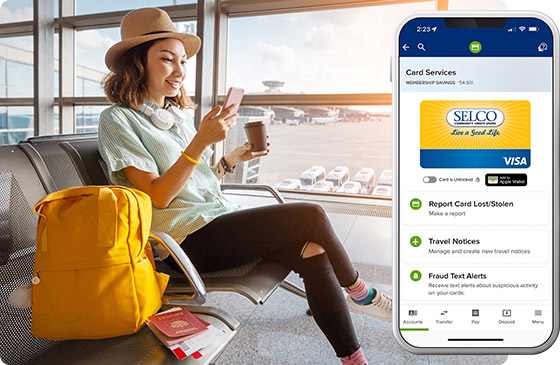

Fight fraud with card controls

Secure your cards from potential fraud with these integrated controls:

- Add travel notices to prevent declines when you’re away from home.

- Turn your cards off and on instantly.

- Set controls and alerts by amount or transaction type.

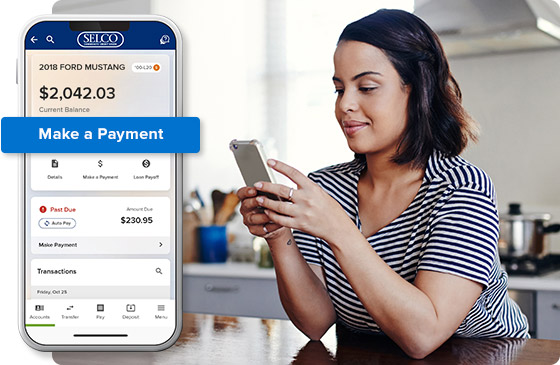

Loan payments made easy

Pay your loan and credit card balance right in digital banking. You can also request skip payments and make additional payment arrangements—all in a few clicks.

Resources

What To Know About ‘Buy Now, Pay Later’

Choosing a "Buy Now, Pay Later" option at check-out is so easy, it almost seems too good to be true. Learn the pros and cons of using these services.

P2P Payment Systems: What You Need to Know

Peer-to-peer (P2P) payment systems are changing the way we handle our money. It’s now easier than ever to pay back friends and family.

What to Know About SELCO Contactless Cards

All newly issued SELCO credit and debit cards are contactless, giving you the ability to simply tap to pay with confidence.

How to Ensure Your Accounts Are Safe

With so much information floating around in cyberspace, it's more important than ever to set up personal firewalls against potential fraud and identity theft.

*Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

1 SELCO Community Credit Union does not charge fees to send or receive money with Zelle®, but there is a $20 stop payment fee to cancel a Zelle® transaction that is still pending because the recipient hasn't yet enrolled. If the recipient doesn't enroll with Zelle® within 14 days, the payment will naturally expire, the funds will be returned to your account and no fees will be assessed. Your mobile carrier's messaging and data rates may apply.